“ Today, with over 500 million mobile subscribers across Africa alone, and more people around the world owning a phone than not, mobile phones seem to be everywhere,” points out FrontlineSMS founder Ken Banks in the opening post of our National Geographic blog series: Mobile Message. There has been a remarkable growth in mobile phone use in recent years, and increasingly mobile phones are being used for innovative social change projects. Last year Ken was awarded the title of National Geographic Emerging Explorer, in recognition of his work in the field of mobile for social change. In December 2010 FrontlineSMS launched our ongoing Mobile Message blog series via National Geographic, to help share exciting stories about the way mobile phones are being used throughout the world to improve, enrich, and empower billions of lives. Here we provide an overview of the diverse range of stories that have been shared in the series so far.

Today, with over 500 million mobile subscribers across Africa alone, and more people around the world owning a phone than not, mobile phones seem to be everywhere,” points out FrontlineSMS founder Ken Banks in the opening post of our National Geographic blog series: Mobile Message. There has been a remarkable growth in mobile phone use in recent years, and increasingly mobile phones are being used for innovative social change projects. Last year Ken was awarded the title of National Geographic Emerging Explorer, in recognition of his work in the field of mobile for social change. In December 2010 FrontlineSMS launched our ongoing Mobile Message blog series via National Geographic, to help share exciting stories about the way mobile phones are being used throughout the world to improve, enrich, and empower billions of lives. Here we provide an overview of the diverse range of stories that have been shared in the series so far.

Mobile for development

In his introduction to the Mobile Message series Ken Banks traces the journey of mobile use in international development from 2003, when “he struggled to find much evidence of the revolution that was about to take place,” up to the present day, when mobiles are now being used globally in projects for health, agriculture, conservation and so much more. From his eight years experience in the ‘mobile phones for development’ field, Ken shares his knowledge on “the importance of building appropriate technologies, the importance of local ownership, and the need to focus some of our technology solutions on smaller grassroots users.” It is these principles that shape FrontlineSMS’s work, and these are also the themes that shape our Mobile Message series with National Geographic.

Mobile Technology gives Zimbabweans a Voice

Mobile phones often have the power to circumvent traditional forms of media, in areas where conventional news outlets are controlled or manipulated by the government. This was clearly shown in the second post in our Mobile Message series; entitled Mobile Technology gives Zimbabweans a Voice. In this post Ken Banks interviewed Bev Clark, founder of Zimbabwean civil society NGO Kubatana, and program director of Freedom Fone. Bev discusses how the use of mobile has helped address the challenge of state controlled media in Zimbabwe and “keep people informed, invigorated and inspired.”

Kubatana runs an SMS subscriber system using FrontlineSMS, and they have 14,000 people on their contact list. They use SMS to share news headlines and notifications of events, and also to encourage a two-way dialogue. They ask subscribers to respond with their views and opinions, by posing questions on social justice issues. By doing this, Bev explains, Kubatana is able to “extend the conversation to people living on the margins of access to information.”

Mobile Banking in Afghanistan

The global presence of mobile phones has also encouraged a wealth of mobile banking (m-Banking) and mobile finance, in areas you wouldn’t necessarily expect. Jan Chipchase, Executive Creative Director of Global Insights at Frog Design, tackled the topic of m-Banking in Afghanistan in the third post of our Mobile Message series. Afghanistan is an interesting case, as Jan explains, being “a country challenged by limited access to traditional banking infrastructure and widespread distrust of formal institutions.”

Jan conducted a field study in Afghanistan in 2010, which focused on use of m-Banking services such as M-Paisa. He looked at how “m-Banking has been extended to include bill payment, buying goods and services, and full-fledged savings accounts.” His study “aimed to highlight the sophisticated strategies that the poorest members of societies adopt in managing their limited resources.” Jan drew some interesting points from his research, and concludes his post by stating that “there will come a point when the idea of using mobile phones for banking will be as globally prevalent as credit and debit are in the U.S. today.”

Technology Helps Break Silence Against Violence in Haiti

Mobile technology is clearly used for incredibly diverse purposes. The fourth Mobile Message post looks at how SMS can be used to help break the silence against violence and human rights abuses in post-earthquake Haiti. Aashika Damodar, CEO of Survivors Connect, writes about how her organisation had worked alongside Fondation Espoir, a Haitian nonprofit organization, to establish a text message helpline to report violent crimes in Haiti.

The service, called Ayiti SMS SOS helpline, provides an option for anyone in Haiti to text if they witness or experience an act of violence. A team of trained helpline operators respond to the SMS, and direct people to relevant services needed to help. As Aashika points out “the need for a reporting system is dire. Thousands of displaced people still live in camps with little security or privacy, making them susceptible to threats and abuse.” Using SMS means help is more accessible to many of those who are vulnerable.

FrontlineSMS is used in this project to manage sending and receive messages. Aashika shares details of why this project chose to build their service around text messaging. “SMS is cost effective, discrete and fast, all of which work to the benefit of our target groups.” This summarises why many projects choose to use SMS to support their social change projects.

Supporting Africa's Innovation Generation in Kenya

As well as increased efficiency, advances in technology also encourage innovation. Erik Hersman, co-founder of Ushahidi, wrote the fifth Mobile Message post about iHub (Innovation Hub); a project that brings together Nairobi's entrepreneurs, hackers, designers and investors. He explains how “leapfrogging PCs, Africa's burgeoning generation of mobile tech-savvy entrepreneurs are bursting with ideas and practical inventions, from African apps for smart phones to software solutions that address uniquely local challenges.”

You can feel Erik’s genuine enthusiasm for the many new and exciting ideas emerging: “real-world solutions to problems found by micro-entrepreneurs and everyday Africans... Here, we see ingenuity born of necessity.” The i-Hub provides a communal space for over 2,500 members of the technology community in Kenya's capital city. There are a growing number of “smart, driven and curious technologists with a leaning towards all things mobile” in many major African cities like Nairobi, Accra and Lagos, and Erik makes clear that “it's an exciting place to be, and the future is very bright indeed.”

Mobile Technology Helps Every Person Count

The sixth instalment of Mobile Message comes from Matt Berg, a technology practitioner and researcher in the Modi Research Group at the Earth Institute at Columbia University. Discussing the value of increased accountability and recording capacity provided by technology, Matt looks at how using tech can help “poor or homeless people be counted as individuals with needs and rights - and receive their share of social resources.”

An example shared in the post is that across the Millennium Villages in Africa mobile technology is improving people’s access to social care in a project called ChildCount+. Matt discusses how “community health care workers (CHWs) register pregnant women and children under five using basic mobile phones and text messages... Using these patient registries, CHWs can make sure that all their children are routinely screened for malnutrition and receive their immunizations on time.”

Through a variety examples of work being done in India and in Africa Matt makes the overarching point that the recording systems provided by technology can provide increased access to services for vulnerable people, who can often get left out otherwise. In short, as Matt puts it, “technology is making it increasingly possible to count things, and thereby to make people count.”

Award winning FrontlineSMS

FrontlineSMS continues to be acknowledged for its powerful work in the field of mobile technology for social change. The latest Mobile Message post is an interview with Ken Banks, based on his recent award of the 2011 Antonio Pizzigati Prize for Software in the Public Interest. Ken received the award for creating FrontlineSMS software, which is now used by thousands of non-profit organisations in over 70 countries across the world.

As we can see from this summary the power of mobile is reaching around the globe, being used in a remarkable variety of ways. Visit the National Geographic website to read any of the above posts in full, and keep an eye out for future posts which we will be reposting here on the FrontlineSMS blog.

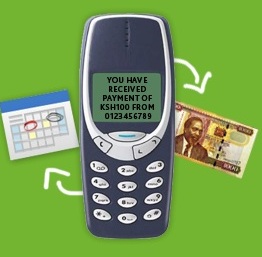

FrontlineSMS:Credit is a sister project of FrontlineSMS, which aims to make every formal financial service available to the entrepreneurial poor in 160 characters or less.

FrontlineSMS:Credit is a sister project of FrontlineSMS, which aims to make every formal financial service available to the entrepreneurial poor in 160 characters or less.

Today, with over 500 million mobile subscribers across Africa alone, and more people around the world owning a phone than not, mobile phones seem to be everywhere,” points out FrontlineSMS founder Ken Banks in the opening post of our National Geographic

Today, with over 500 million mobile subscribers across Africa alone, and more people around the world owning a phone than not, mobile phones seem to be everywhere,” points out FrontlineSMS founder Ken Banks in the opening post of our National Geographic